“Regression to the mean” is a powerful force in the financial markets, so it was a good bet that the 60:40 portfolio would have a much better year in 2023 than in 2022.

But not as good a year as it has had so far. That’s important to point out, lest retirees start believing that returns like we’re seeing this year are the norm. They’re not.

The 60:40 portfolio, a default option for many retirees and near-retirees, lost 23.4% last year, assuming the 60% equity portion was invested in the Vanguard Total Stock Market ETF

VTI,

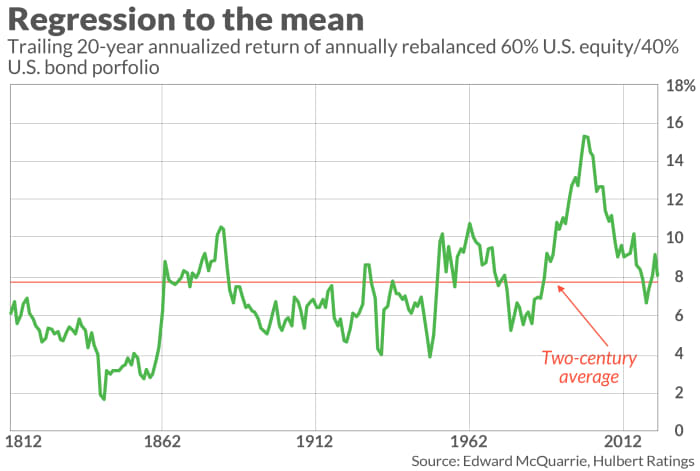

Through the end of May this year, in contrast, this portfolio rose at an annualized pace of 17.6%. That is more than double the average return since 1793 of 7.7% annualized for an annually rebalanced portfolio (according to data compiled by Edward McQuarrie of Santa Clara University).

Regression to the mean deserves only a minority of the credit for this reversal. That’s because there’s no guarantee that, following a year with as big a loss as 2022’s, the portfolio would produce a gain this year. Strictly speaking, in fact, all that regression to the mean implies for the 60:40 portfolio is that its return this year would be closer to its long-term average than last year’s. A wide range of possible returns are consistent with this implication, of course, including a loss—just so long as that loss is significantly less than 2022’s.

Rather than thanking mean regression, retirees therefore should thank their lucky stars that the 60:40 portfolio’s year-to-date return is coming in at the upper end of this possible range.

But I need not remind you that luck is not a strategy.

It’s also important to remember that regression to the mean cuts both ways. Assuming that the 60:40 portfolio continues performing for all of 2023 at its year-to-date pace, mean regression would imply a smaller return in 2024. That smaller return could still be a gain, of course, but it also could be a loss.

In any case, it’s worth emphasizing that the 60:40 portfolio is a long-term bet, not a market timing tool. As you can see from the accompanying chart, this portfolio’s most recent trailing 20-year annualized return is almost precisely on top of its two-century average of 7.7% annualized. So no regression to the mean is implied when projecting the portfolio’s long-term future return.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.