Tesla Inc. has inked another fast-charging deal with a major U.S. automaker, this time with General Motors Co., sending shares of both EVgo Inc. and ChargePoint Holdings Inc. lower. But only one of those two EV-charging companies needs to worry.

News of the Tesla

TSLA,

See also: Tesla to open charging network to GM next year; GM, Tesla shares rally

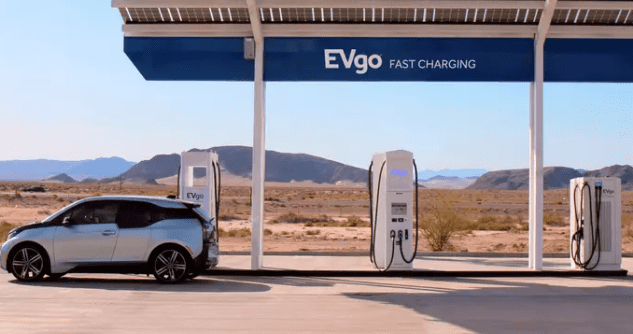

In its statement late Thursday, GM specifically reiterated its commitment to the collaboration with EVgo and truck-stop operator Pilot Company’s fast DC chargers. But that won’t prevent investors from being “uneasy” about the Tesla agreement, the BofA analysts, led by Alex Vrabel, said in their note.

EVgo and Pilot, whose majority owner is Berkshire Hathaway Inc.

BRK.B,

EVgo will compete more directly for utilization against Tesla’s “highly reliable network” serving a larger piece of the future EV fleet, the analysts said. They kept their rating on EVgo shares at the equivalent of sell, saying there are “new uncertainties which further obfuscate the line of sight to positive cash flow generation.”

In contrast, ChargePoint does not face direct risk on utilization, and its DC Fast network is largely fleet focused, the analysts said. They kept the equivalent of a buy rating on ChargePoint shares.

TPH analysts also saw more risk for EVgo and its DC model. In the short term, EVgo “has solid line-of-sight to stall growth” via its existing agreements, they said.

But the “magnitude of impacts to longer-term growth and utilization trends likely to come to the forefront as Tesla’s scale advantage from a manufacturing perspective could hamper EVgo’s ability to compete for market share,” the analysts said.

However, given that the U.S. is in the early stages of its EV-charging infrastructure buildout and much more is needed, there may be room for all, the TPH analysts said.

Tesla CEO Elon Musk said back in July 2021 that he would open Tesla’s Supercharger to other EVs, although he promised that would happen by the end of 2021.

Other EVs began to be allowed to charge at Tesla’s fast-charging stations, usually located by exits off interstate highways and other major arteries, last year. Tesla created its own connector because there were no standards when it started, and it was the only maker of long-range cars, Musk said then.

The standard that both GM and Ford said they will adhere to soon, the North America Charging Standard, or NACS, is indeed the one pioneered by Tesla. Ford made its Tesla fast-charging announcement late last month.

GM, Ford and other automakers currently use the Combined Charging System, or CCS, as their charging connection, which is standard in most EVs in Europe and other regions. Tesla has made NACS open source, which means more products that use it are hitting the market.

Both GM and Ford have said that they will have adapters for their EVs within the next year and that by 2025 their EVs will come with NACS as standard.

Thursday’s announcement was a “positive” for GM, as it eases consumers’ charging concerns, the TPH analysts said.

Shares of EVgo have lost 18% so far this year and shares of ChargePoint have lost 13%. The S&P 500

SPX,